Whale Analysis of Bitcoin, Dogecoin, and Ethereum

Jul 2022

Length: 2m (at 0.5 FTE)

Programming language: Python (Pandas, NumPy, requests, Beautiful Soup, RE, datetime,

Matplotlib, seaborn)

Data:

- Circulating supply of BTC, DOGE, and ETH, on 12.07.2022

- Genesis date of Bitcoin, Dogecoin, and Ethereum (when the first block was processed and

validated on each blockchain)

- Top 100 richest BTC, DOGE, and ETH addresses (on 12.07.2022), including their current balance, whether

they are an address owned by a centralized exchange (CEX), their number of transactions,

and the dates when they performed their first and last transactions.

Problem description:

Investigate the decentralization degree and trading patterns of the richest BTC, DOGE, and

ETH holders

Approach:

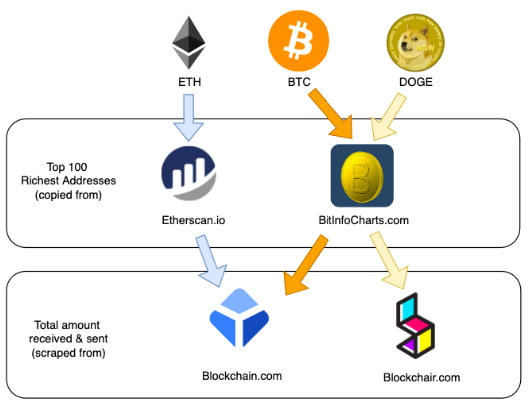

The first step involved acquiring the appropriate data. The figure below displays the sources

where the data was gathered. Accordingly, after the collection of the top 100 richest holders,

the total amount sent and the total amount received by each address were scraped from a block

explorer.

Afterward, the data was processed for analysis by converting the available variables to the

appropriate types, plotting variables to seek outliers, and extracting additional features,

such as the accumulation and offloading intervals and the number of days from genesis to the

first transaction. Lastly, various checks were performed to ensure the validity of the data,

which resulted in some addresses being deleted. For instance, every address needs to have at

least the same amount sent out as the total amount received since it is impossible to spend

an unavailable quantity of a cryptocurrency. However, three Ethereum addresses did not comply

with this. Another check verified if the date of the first transaction is always the date of

the first in-transaction because an address first needs to receive in order to spend. Again,

three other Ethereum addresses failed this inspection.

Results:

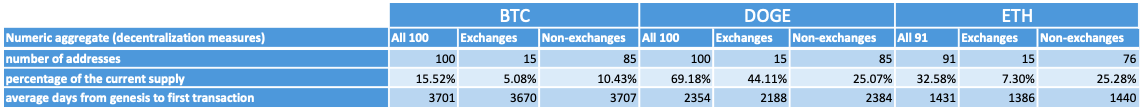

In the table below, one can see the numerical aggregations concerning the decentralization

measures of the three cryptocurrencies. Looking at the percentage of the current supply, one

can observe a considerable centralization degree in the case of Dogecoin, where the top 100

addresses hold roughly 70% of the total supply of DOGE. This number decreases to 33% for

Ethereum and 16% for Bitcoin. Furthermore, in the case of Dogecoin, the centralization is

even more pronounced taking into account that 44% of the total supply belongs to CEXs, which

are known to be government-liable entities, whereas, for Bitcoin and Dogecoin, the non-exchanges

hold the larger proportion.

Next, the average number of days from genesis to the first transaction suggests the most

early adopters for Ethereum, followed by Dogecoin and Bitcoin. This is also the opposite

order in which the three were deployed. Hence, one possible explanation is that, as the

crypto field increased in popularity, the richest accounts started investing faster.

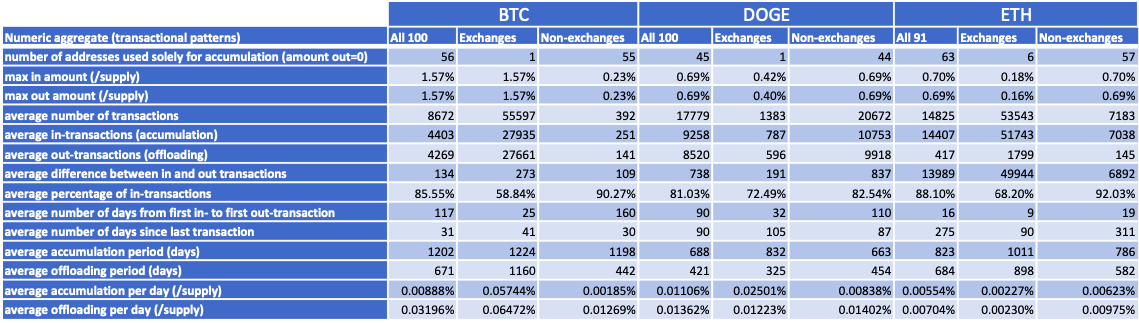

The following table displays the numerical aggregations generated to provide valuable information

for comparing transactional patterns. When it comes to the values expressed in days, these were

rounded down, whereas, for the amounts in crypto, the entries were converted to a percentage

after being divided by the circulating supply of the respective coin, such that a comparison

inter-blockchain is viable.

Among the most important findings are the significant proportions of non-exchanges used solely

for accumulating BTC and DOGE in contrast to ETH, where the difference is not as substantial.

Then, one can notice the average number of transactions being very low for the richest,

non-exchanges holders of BTC, supporting that these accounts were mainly for accumulation

rather than trading. Nevertheless, this does not hold for Dogecoin, whose non-exchanges

were more active than the exchanges.

Additionally, one can observe a higher average of days from first in- to first out-transaction

for non-exchanges across the three cryptocurrencies. As expected, Ethereum has the lowest

intervals, probably due to its fastest transaction speed. Ultimately, Bitcoin holders had,

on average, a lengthier accumulation period, which was anticipated given the blockchain is

also the oldest among the three.